Business guides

Unlock the potential of your business with our practical guides.

-

Economic commentary

Our monthly update on global, UK and Scottish economic trends and performance, drawn from a wide range of economic indicators and commentaries. Published April 2024.

Date: 22 Apr 2024 -

Manufacturing success: five things to consider

Learn from Nick Shields, Head of Business Services and Advice at Scottish Enterprise, who discusses five factors crucial to sustained success in manufacturing - from focussing internal ambition to building supply chain resilience.

Date: 26 May 2023 -

How to build a sustainable supply chain

What is a sustainable supply network? Learn about the benefits of supply chain sustainability for your business. Then get 10 tips on how you can work with suppliers to reduce emissions.

Date: 14 Mar 2022 -

Financial readiness guides

Watch our financial readiness guides to learn about different types of funding and how we can help you access finance for your business.

Date: 16 Mar 2023 -

Five ways to boost workplace innovation

With the cost of doing business rising, workplace innovation can deliver a range of benefits to your organisation. It’s an incredibly effective way to increase efficiency, boost productivity and retain talent.

Date: 16 Mar 2023 -

Six steps to exporting success

New to exporting? Here's how to get started. We’re here to help navigate the steps your business should take to thrive in the new trading landscape. Lauren Tardito, our Trade Digital Specialist, shares her tips on ecommerce, strategy, documentation requirements and international markets.

Date: 22 Mar 2022 -

How to achieve net zero emissions: checklist for businesses

Scottish businesses are showing a growing interest in reaching net zero carbon emissions. This article explores the trend. Get insights from our team of sustainability specialists on what it takes to reach net zero. Read our 10-step checklist to ensure your strategy is as effective as possible.

Date: 08 Mar 2022 -

How to develop a successful innovation strategy

A strong innovation strategy helps your business get the most out of its new ideas. With the right approach, you can boost resilience and create sustainable growth. Paul Cross is one of our Innovation Team Leaders. In this guide, he discusses the growing need for business innovation and offers five steps to help you succeed.

Date: 25 Feb 2022 -

How to calculate your carbon footprint

Calculating a carbon footprint for your business can help you accurately track and report your progress towards low carbon or net zero. This guide helps you take the first steps. Learn how to choose and collect the right data for your organisational footprint.

Date: 18 Feb 2022 -

How to sell your business to an employee ownership trust (EOT)

Thinking of moving to an employee ownership model? Co-operative Development Scotland (CDS) can provide you with guidance and support throughout the process.

Date: 21 Jan 2022 -

Building business resilience

We often hear media commentators talking about building a resilient workforce - but what does the word 'resilience' mean in this context? And how does it apply to your workforce?

Date: 25 Jan 2022 -

Circular economy for business

Get guidance on circular business models and find five tips for making your business more circular.

Date: 01 Oct 2021 -

Develop a low carbon strategy for your business

Many companies in Scotland are working to reduce their greenhouse gas emissions and transition towards being low carbon operations. This guide explores what low carbon and net zero mean, why it’s worth developing a low carbon strategy for your business and how you can do this successfully.

Date: 09 Sep 2021 -

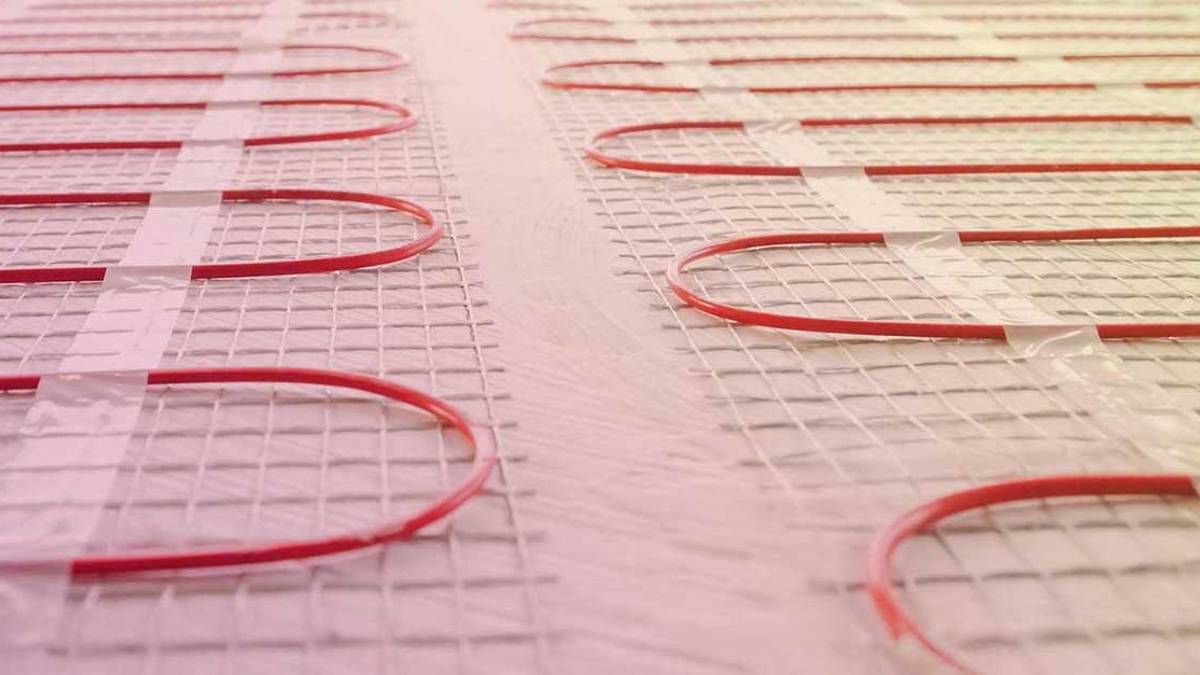

Clean heat: low carbon heat opportunities

Clean heat will play a crucial role in meeting Scotland’s net zero targets. There’s huge growth potential for Scottish businesses too. Find information and support on immediate, large-scale opportunities in the low carbon heat market.

Date: 14 Oct 2021 -

Sustainability-driven innovation: how it can help your business

Adopting sustainability-driven innovation practices can bring many benefits to your business. As well as helping the environment, it can reduce your costs, build your resilience and give you a real competitive advantage.

Date: 26 Oct 2021 -

Succession planning guide

Our succession experts can give you free advice on ways to exit your business. Alistair Gibb, a succession adviser, explains the main options available to business owners in our series of short videos.

Date: 10 May 2021 -

Scotland's low carbon future

There are many challenges and opportunities as Scotland transitions to net zero, but it is ideally placed to play a leading role in the journey to a global low-carbon future.

Date: 02 Nov 2020 -

5 tips on achieving business sustainability

Developing a sustainable business will ensure your company has the capacity to endure, minimise your environmental impacts and help you take advantage of net zero and climate change opportunities.

Date: 02 Nov 2020 -

Selling online

Get useful guidance on how to sell online effectively and find out about the support we can offer to help your business reach new and existing customers online.

Date: 18 Aug 2020 -

Inclusive business models

Co-operatives and employee-owned businesses can help create a fairer and stronger economy.

Date: 10 Mar 2020 -

Employee ownership guide

Could switching to employee ownership help your business? Learn more with Carole Leslie, a specialist adviser at Co-operative Development Scotland, and get the information you need in our series of short videos.

Date: 10 Mar 2020 -

How to find a supplier for your business

Supply chain mapping is a useful tool for better understanding your supply chain. This guide will take you through how to map your supply chain and provide an overview of UK directories for key industries.

Date: 09 Mar 2020 -

Becoming investor-ready

Find out how you prepare your business to the point where equity investors would be willing to support your growth aspirations.

Date: 23 Jan 2020 -

How to lead a successful international team

Understanding cultural differences is an essential tool to achieving organisational effectiveness, but managing international teams isn’t always straightforward. Leadership and business culture guru Erin Meyer shares her advice.

Date: 01 Oct 2019 -

What is equity funding?

If your business doesn't have the revenues or financial history necessary to successfully apply for a business loan, equity funding is another option.

Date: 06 Dec 2018

-

Sign up to email updates

Subscribe to our newsletter to hear about new business guides, case studies, events and industry updates.